- Credit Connect Solutions

- Repossession

Repossession

Repossessions by Credit Connect Solutions

Dispute, Repair, and Recover from Repossession Marks on Your Credit

Offered by Credit Connect Solutions – Irvine, CA

A repossession can feel overwhelming, but it doesn’t have to define your financial future. Whether it happened recently or years ago, the effects can linger on your credit report. However, at Credit Connect Solutions, we step in with proven solutions. First, we help dispute any inaccurate records and then do Credit Report Repair . Then, we assist in negotiating with lenders. Finally, we guide you in rebuilding your credit. With expert help and ongoing support, you can move forward with greater financial clarity and confidence.

Discover MoreWhy Choose Repossession with Credit Connect Solutions?

It is considered a major derogatory event and can stay on your credit report for up to seven years. Its impact includes:

Increased scrutiny from future lenders

Higher interest rates or loan denials

Long-term barriers to rebuilding your financial stability

What Is a Repossession?

It occurs when a lender seizes a financed vehicle due to missed payments. This is most common with auto loans but can also happen with leased vehicles or other financed assets.

There are of two types:

Voluntary – You return the vehicle to the lender yourself

Involuntary – The lender takes the vehicle without your direct consent

Both types are reported negatively on your credit and may lead to:

• A drop in your credit score

• A deficiency balance (you may still owe money after the vehicle is sold)

• Collections or legal action

• Difficulty qualifying for future auto loans or financing

Get your FREE

business consultation

How Credit Connect Solutions Helps?

We use a structured, legal, and client-focused process to help address and reduce their damage:

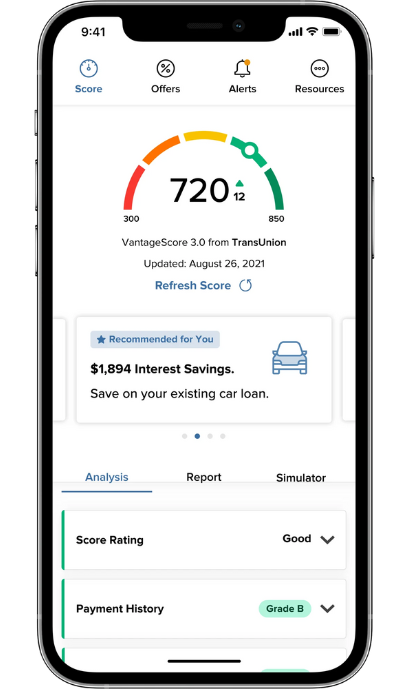

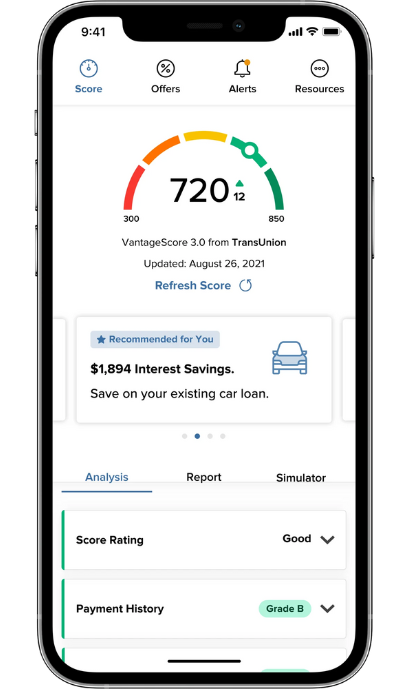

Credit Report Evaluation

We start by reviewing your credit reports from Experian, Equifax, and TransUnion to assess how it is being reported and whether it’s accurate or incomplete.

Dispute & Investigation

If any part of it entry is inaccurate, outdated, or unverifiable, we file disputes under the Fair Credit Reporting Act (FCRA) to challenge the entry and request correction or deletion.

Deficiency Balance & Negotiation

If there is still a balance owed, we can support you in negotiating a settlement or even a pay-for-delete agreement, depending on the lender’s policies.

Credit Rebuilding Plan

Once it is addressed, we help you move forward with strategies to rebuild your credit—from securing positive tradelines to managing utilization and payment history.

Common Reporting Errors Credit Connect Solutions Catch

• It is listed after full payoff or settlement

• Duplicated entries by the original lender and collections agency

• Incorrect balance amounts or payment history

• We reported beyond the legal timeframe

Mission is to Protect

your Businesses & Much More

Contact UsNewsletter

Subsrcibe for our upcoming latest articles and resources

Contact

5000 Birch Street West Tower Suits 3000, Newport Beach CA